The 3 Lessons I Learned After Accidentally Buying a Liquor Store

February 18, 2014

I bought a liquor store last year….it was sort of an accident.

No, I wasn’t binge drinking at the time. I wasn’t really shopping for a liquor store. I wasn’t even shopping for a bottle of wine. But, here I am … proud owner of a liquor license and a terrific selection of craft beers, pinot noirs and small batch bourbons….among many other standard liquor store offerings.

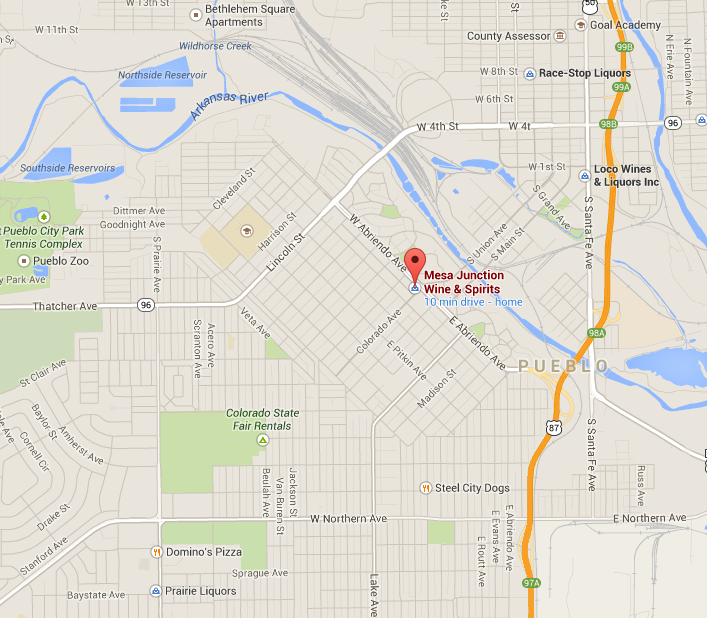

Since 2010 I’ve been investing in real estate in Pueblo, Colorado and when a commercial building with retail on the ground floor and multifamily residential on the second floor was listed for sale I went to take a look. I liked the building, especially the location in the heart of Pueblo’s Mesa Junction neighborhood. As I walked around with the owner, it became clear that the liquor business was being sold with the building.

Hmm. Intriguing. My college buddies would be so jealous.

So, deciding to roll the dice, I made an offer. I fully expected a counter-offer that wasn’t sufficiently attractive, allowing me to walk away and go back to business as usual.

Instead, the owner accepted my offer…..hey, that’s great newwwwzzz….holy shit.

With the building under contract I began due diligence. I remember thinking, before I ever contemplated the notion of liquor store ownership, retail liquor stores enjoy a tidy little monopoly. Must be nice. Well, yes and no. It’s not quite as easy as it sounds. Since taking ownership of the store I’ve learned a few things about the liquor business that might surprise you.

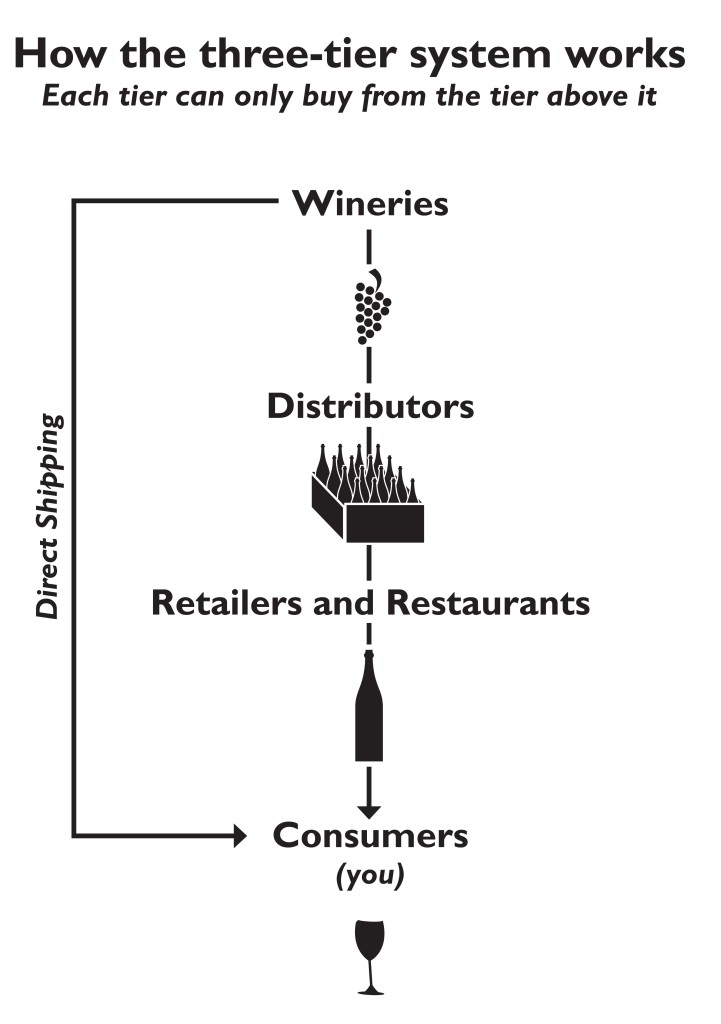

Lesson 1. The liquor business is highly complex. Retail liquor, at least in Colorado, is a fascinating business. Huge number of SKUs. The quantities of categories, brands, flavors, price points and size variations are mind-numbing. Talk about Big Data. Liquor distribution is heavily regulated in Colorado with a 3-tier system composed of manufacturers, distributors and retailers; each tier has its own set of rules and requires its own special license with an application paperwork trail that only a lawyer could love. Inventory is expensive and margins are thin, managing inventory and cash flow is extraordinarily difficult and SKU level demand is nearly impossible to forecast accurately. Running a small liquor store requires business acumen – accounting, operations, human resources, customer service, marketing, sales – the whole enchilada. If you were thinking that a liquor store is like an advanced lemonade stand you’re completely underestimating the task. This is good by the way. Communities need opportunities for individuals to learn how to run a complex business with full P&L responsibility.

Lesson 2. Distributors hold all the power. As a retail liquor store owner I am only allowed to purchase inventory from a licensed distributor. Seems reasonable to keep tabs on who’s moving liquor around the state. But, here’s the catch. Every licensed distributor has a complete monopoly on every product they sell. So, any self-respecting liquor store should have various sizes of Jack Daniels on the shelf, right? I think I’ll call around and see who has the best deal on a case of 750 ml bottles of Jack, compare prices/terms and place the order, right? Wrong. If you want to buy Jack Daniels or any other product whether it’s a brand of beer, wine or spirits, you have your choice of exactly one distributor who carries that product. So, negotiating price isn’t an option. The only possible way you can get any sort of discount is by purchasing large volumes. As a result, the distributors pass along more favorable prices to the mega-stores who can afford to purchase 100 case deals; if you’re a small liquor store you just have to bend over and take whatever price is offered. When I learned this was the way the system worked I was stunned. What? [fade to the Caddyshack scene with Chevy Chase talking to Danny Noonan, “Is this Russia? This isn’t Russia.”]

You mean to tell me that we aren’t allowed to shop around for a supplier who might provide better service, better prices or both? Nope. The Budweiser distributor welcomed us to the industry by requiring cash upon delivery for the first 90 days. No checks. No 30-day net invoice. Not even a money order. Cash on the barrelhead. Nice manners, Bud.

Lesson 3. Owning and operating a small liquor store can provide a comfortable income and job security but it’s no cash cow. If you read my About page you’ll see that I have a day job in a completely separate industry. I don’t work in the liquor store. I hired a manager to run the operation and she supervises a handful of employees who staff the store when she can’t be there. She’s paid a decent salary providing a reasonably comfortable living in Pueblo. We pay hourly employees a decent wage as well. It’s not lucrative but I’m willing to bet we pay better than comparable positions at local grocery or convenience stores. The store is humming along. We did a good bit of business around the holidays and customer traffic is steady. But here’s the thing. This business is not designed for an “absentee” owner because after payroll and inventory replenishment there’s not much left over. However, the setup is perfect for an owner-operator.

As an owner-operator of a liquor store you have roughly the same job security as a tenured college professor. The store could go under if you fail to compete effectively or if the market for liquor dries up somehow (just like a school could close or an academic department could be eliminated). And, your take-home pay will vary with some years better than others depending on volume. But, so long as you have customers who walk in the door, no one can really take away your job.

Sure, I wish the store was a huge cash cow; you know, pay myself a nice salary every month and do whatever I want all day. Sounds great in theory but as a member of the community I’m glad it’s not so easy because big corporate greed would quickly follow. It’s nice to have the owner behind the counter. Customer service is better. And, it’s nice that the liquor store provides a comfortable income. That way the owner is highly unlikely to sell booze to minors – there’s too much at stake to break the law for a few extra bucks. Mostly, it’s nice that a big company can’t swoop in and take over every liquor store in sight. In the name of low prices, they’d shut most or all of the small stores down and open newly constructed mega-locations on the outskirts of town where land is cheap and profit maximized, laying to waste neighborhood small markets within walking distance….sort of like what’s happened with the grocery industry.

This dispersed single-unit ownership system is better for the community because it provides economic activity in a variety of locations along with solid living wage jobs that can’t be readily outsourced or automated. More people have skin in the game and a strong incentive to take care of their stretch of sidewalk in the community. In fact, aside from the distributor monopolies and the cumbersome government licensing process, it just might be a model worth considering for distribution of other commodities, like fresh food.

But that’s a topic for another blog post.

388 Comments

[…] you follow my blog you may have read that I purchased a liquor store last year. One of the lessons I’ve learned since is that a small liquor store is a great […]

Hi Justin,

Are you feeling any impact from big box stores?

Thanks,

Kat

Hi Kat – it’s hard to say. I think if someone is going out to do a big shop they are more likely to go to one of the big box liquor stores rather than to our small store. But for most of our customers the convenience of our location is a more important factor. Other customers come specifically to see our manager and benefit from her knowledge to get good wine or craft beer/spirits recommendations. Hope that answers the question for you. Best, Justin

To me this is number one in choosing where I spend my money, no matter what the item is. I am willing to pay more for this type of service. This is lost in big box stores. I can remember the day of good advice at stores, car part shops, etc. It won’t be long when no one remembers as my generation retires and “moves on.” It might not be such a concern to the millennium generation, so Corporate America can keep squeezing the middle class to funnel funds to the board and CEO’s. That is such a shame what they have done to our country.

Cutter

Cutter, it is indeed a sad state of affairs. We’ve sacrificed local economies and real estate values for lower prices on doodads and processed food. As part of the deal our communities have become more car dependent and less business savvy. Residents complain about the struggling local economy yet send their money to Wall St via 401k plans rather than investing locally. And no one seems to notice the irony. Thanks for sharing your thoughts. Best, Justin

Justin, just a quick question. In the restaurant business there are manufacture rebates and spiffs available that if worked diligently can really effect your bottom line. As I know price negotiating with suppliers is impossible without substantially increased volume with beer and liquor, I was wondering if rebates/incentives are available from liquor manufacturers?

Hi Jay, I’m not aware of any such programs but I may have missed the boat. In Colorado you can buy directly from Colorado-based manufacturers but most small brewers/distributors have either already made exclusive deals with distributors or can’t afford to make major price concessions on small orders. Best, Justin

I am a proud owner of a liquor store for more then 10 yrs. Amazing how close and sharp your notions are for the nature of the business . Same kind of problems we have here in NJ. Big businesses with the deep pockets have all privileges of buying cheep and drive the prices down. Our privilege is locality and customer-friendly service. Amen. But, but

My only hopes it will stay the same way for another 10, or so yrs., because longer you stay in a business, more money you make.

Hi Lora,

Nice to hear my article resonates in NJ.

Best wishes,

Justin

Hi Justin, thanks for sharing your experience and wisdom with us. I am from Colorado Springs and in 2017 accidentally I purchased a property with a flower shop. Last month I sold my business with real estate and I was almost about to buy a liquor store. But thank God I did a Google search and found your article. I need your help to find a new opportunity. I feeling completely lost and don’t know what to do next.

If possible love to meet with you in Pueblo or Colorado Springs. Looking forward to hearing from you. Thanks!

Hi Francis,

I’m not sure I can help but I sent you an email.

Best wishes,

Justin

[…] if you read my blog regularly you’ll know that I’m biased because I happen to own a liquor store in Pueblo. And, even though the store is currently for sale I recognize this as a clear conflict of interest […]

Thanks for the info. My husband and I would like to buy or start one in a small northern colorado town. With the oil and gas influx the traffic would be good. I am an accountant and am looking to change. This would be my undertaking.

Hi Brenda, best of luck to you and your husband! Be sure to start with a good war chest of cash so you can take advantage of volume deals on your best SKUs! Cheers, Justin

Hi Justin,

Very good information and clearly explained. My partner and I are studying the possibility of buying a liquor store in Miami and we are just studying the same issues you mention in your blog.

Good job, thank you.

Caesar.

Hi Caesar, thanks for the comment! Glad to hear that some of the info is transferable to other States. Best wishes to you and your partner! Cheers, Justin

Hi Cesar,

I know your post is a couple years old now but, I have been looking in the South Fla area as well for a liquor store. I would be interested in comparing note/sharing information, if you wouldn’t mind.

Thank you, hope your venture was/is successful.

Hi Lazaro,

I’m Pierre and I’m studing the liquor store business in Florida for the last moth.

Will be glad to sit and talk about our business point of view, share ideas and opinions.

Take Care

Pierre

[email protected]

Hi Justin,

How small of a store is Mesa Junction? Just trying to differentiate between a Mom and Pop operation and a megastore.

Thanks,

Adam

Hi Adam, the store area is 2600 sq ft with about half of that accessible to customers. We have 2 employees working during business hours but just 1 register. Not sure if that’s what you’re looking for – I can’t reveal financial information here. Best, JH

Hi – I’m thinking of just specialty beer (and maybe wine) shop in CA. License is *much* cheaper, but can’t make as much per sq. ft. of space, and will require substantial refrigeration. Do you think this model is viable? Or is hard alcohol required to make it profitable?

Hi Tom,

I don’t really have sufficient expertise to provide useful guidance here. What I will say is that, at least in Colorado, profit margins on liquor (hard alcohol) are quite a bit higher than they are for beer. I would imagine you would also lose a whole lot of revenue as beer aficionados may also need to grab a pint of Jack Daniels from time to time. Rather than focusing on specific product categories I would suggest focusing on a specific customer segment. Talk to beer aficionados and find out what they would want on the shelves. I’m guessing they would want to see some standard wine and liquor offerings for convenience. Hope this helps! Best of luck!

Justin

Thanks! Great info.

Justin, I know you posted this comment quite a while ago, but I have some experience with what you’re talking about. In 2012, I opened a small boutique store that specialized in fine wine and craft beer. We had weekly wine and cheese parties, sold a variety of accompaniments, made seasonal gift baskets, and even even held raffles to bring in extra business. There was absolutely no shortage of customers, but the business itself was simply not lucrative enough to thrive. We had a loyal customer base and our location was ideal for this type of store. The problem was just that profit margins on those kinds of items aren’t high enough to maintain a business on. I closed the doors of the store after a year and a half of consistently shoveling money out of my pocket into the business account. I don’t want to get too into the actual numbers, but I ended up taking a pretty massive loss on that business.

I’m sorry, that response was directed at Tom, not Justin.

Cody

in which state were you located ?

Hi 🙂

You know the life of a entrepreneur is start and fail…till one day you find your thing and sucess 😉

Where in CA Tom?

What’s going to happen with the new petition to let grocery stores sell hard stuff? Would this pass? will it put a lot of liquor stores out of business?

Thanks!

Grocery chains have been trying to change the liquor laws for years. The liquor lobby seems to have the upper hand, at least for now. If laws were to change, liquor store owners would need to innovate to survive. Some locations would have no chance.

This applies only to Colorado.

Hi Justin, a couple questions.

1. Wonder if you’ve heard any new news around the grocery push to get full alcohol sales? I’m considering a pre-retirement investment in a Denver store, but very wary if the law changes in 2016 which I’ve heard is gaining strong support.

2. Sounds like you had a store in a suburban median income area. Did you find it difficult to decide what crafts to bring in with all the proliferation of skus?

Thanks so much.

Jon

Hi John,

The big grocers have been trying for decades to get full alcohol sales. So far they’ve failed and I think they’ll continue to fail; but they will certainly keep trying and .. who knows … maybe they’ll get their way one of these years. I hope not but stranger things have happened. I would avoid liquor store locations in shopping centers right next to large grocery stores. They will be the first to go under if the laws change. I prefer urban locations to avoid the Big Box developments. You might also keep an eye open for stores with large enough square footage to allow for conversion to a grocery + liquor market if the laws change. I would expect some sort of transition period if they do make the shift. Still, I would bet against it.

My store location was urban and fairly low income. We mostly had a difficult time keeping the cheapest 24-oz beers in stock. SKU proliferation is a big problem. It’s so expensive to have a good selection of craft beers, craft spirits, wine and everything else that people want to see on the shelves. My advice is to have a huge pile of cash in the bank to provide a cushion.

Hope this helps. Good luck!

Best,

Justin

I know you cant mention profits or cash flow, but could you share an estimated ROI from your store?

Hi Ruben, it’s difficult to say and probably warrants a separate blog post. I’ve now sold the store and still own the real estate. The new store owner will probably exercise an option to purchase the real estate in 2015. When all is said and done I expect to have at least doubled my investment capital. Probably more. But my profit has more to do with buying the store + real estate at a good price than anything else. I didn’t make any money operating the store. If you’re looking for a buy/hold situation you have to be willing to work at the store as your regular gig for it to make sense. As a passive investor you can either make money by flipping, like I did, or by purchasing a higher volume store with more potential to generate regular cash flow. However, this latter option requires a much larger pile of cash up-front. Hope this helps. Best, Justin

Thanks you for this article i found if very informative. I am looking for a small business opportunity in NY. I understand this business isnt a cash cow and the margins are thin but you also describe is as stable and able to provide a comfortable living. Would you suggest this a a valid first time business owner opportunity? what percentage of your gross income results in owners cash? this is and example of a store for sale in my area does this seem reasonable?

Asking Price$199,000.00

Gross Revenues$589,862.00

Financing$ 199,000.00 Down and Sales Price does not include inventory

Owner’s Cash Flow$91,920.60

Hi David, glad my post was helpful! In your example, the asking price is about 33% revenue which is a bit high. Try for something in the 25-30% range so if you like what you see maybe offer $150k. If the owner is providing financing it will be more difficult to get a lower price. Another key factor is real estate – can you buy the real estate? If not, are good lease terms available, etc. Cash flow of $90k on a store doing $590k is solid and probably requires that you work a *lot* of hours. You could hire help if you’re willing to pay yourself less. I do think a liquor store is a decent first time business owner opportunity. Just be sure you have a good pile of cash in the war chest for start up expenses. You’ll make mistakes – some of them expensive – and you need a cushion. Think of it as tuition to be paid. As a reward, so long as the location is good, you’ll have job security most can only dream about. And 90k/yr isn’t a bad salary to go with it. Just don’t count on it in year 1. Hope this helps. Cheers, Justin

Good advice for those considering a liquor/wine store as a business. I have owned a liquor store/beer store/wine store going on 6 years. Retired from IBM at age 55 and have been operating this store ever since. My brother and I both put up 150.00 to buy this business. We have a long lease. I’m afraid the lease may last longer than my brother or I. My brother and his wife and I and my wife operate the store. My brother and I each draw 90,000 a year. Wives are not paid. We are in Texas and it never ceases to amaze me how consistent the revenue is from one year to the next. In our six years we have been very fortunate to have minimized the mistakes that most new business owners make. The one thing that really stands out is your statement, any liquor store owner is at the mercy of the distributors. How true it is.

Rickey – thanks so much for sharing your experience and thoughts! Congrats on retiring from Big Blue and moving to a situation where you have more control over your own destiny (aside from those darn distributors). Thanks also for sharing your purchase price (I assume you mean $150,000 each?) and annual draw. I’m sure this is a huge help for others considering a similar move. I went into my own venture with too little capital, underestimating the amount of money needed to accommodate proper inventory levels and cash position. Thanks again and best wishes, Justin

I am trying to buy a liquor store in Memphis, TN. I need your help! Thanks 901-281-7762

please call me anytime

What’s my commission? 😉

You are a life saver!!! I need help buying a liquor store. Can you call or text me at 832-335-3661. Thank you Justin

Hi,

Do you have one or couples of mistakes that you’ve done in your liquor store?

Hi Justin.

Thanks for your insight, it was very helpful. My husband and I currently own a 7-11 franchise in northern colorado but are considering leasing the building next to our store and opening a liquor store. (Unfortunately, I don’t think the real estate would be an option to buy) What advice would you have in terms of installing equipment? Do you think we should try to negotiate some of that cost into our lease agreement? (I’m also not sure what a good deal would be on leasing a commercial space, it’s not a very large space) Do you have a rule of thumb in terms of competition compared to the surrounding population? Lastly, can you educate me on what you can and can’t sell? (Soda,juice, crackers, limes?) Did you do any in-store beer/wine tasting at your store? If so how does the licensing work for that?

Thanks again!!

Hi Ashley! Could you carve out a portion of your existing 7-11 for liquor sales? That might be better. It’s possible under Colorado Liquor Laws. You just need separation between the two areas within the store. Doesn’t need to be a wall. You also need separate cash registers. But that’s it. Worth investigating. For lease negotiations, competition, non-liquor items, tastings, etc I will try to answer when I have more time. Let me know what you think about dividing the 7-11. Cheers, Justin

Hi Justin, you are a wealth of information, I wish I could add you to my pocket in our venture. We are selling a business in the next few months and looking to purchase a liquor store in Colorado Springs area and we would own/operator the business ourselves. We see a sea of liquor stores for sale and wondered why and if it would be a wise choice for us. We are both in our ‘upper” ok fine, top 40’s and are moving to Colorado where the weather is not as extreme as Minnesota. We have owned and operated our existing business for 10 years and neither one of us is afraid of putting in the time to succeed. What other experience and advice would you be willing to share that would help us decide if this is the right choice. We do not want to purchase a store that has a lease, we would want to buy one that has the building included in the sale. We would also be going into this business with a good savings for purchasing inventory as we know there is always a large investment in inventory and we would always pay our vendors at delivery.

Hi Penny – location is everything in this venture. You’ve already narrowed down to Colorado Springs but I think you should look carefully at the density of existing stores to assess competition before making any commitments. Maybe there are too many stores in the Springs and that’s why so many are for sale? Not sure. That would be a good question to answer. You can add me to your “pocket” for the transaction if you change your mind and target Pueblo instead. We need good business people with solid Midwestern values to help improve the economy in Pueblo. Plus your real estate dollar will go about twice as far as it would in Colorado Springs. Good luck! Best, Justin

Any ideas on how to promote a new liquor store that been opened for 2 months in Houston, Texas

Hi Tamara – I don’t know much about the subject but I think it depends on location and customer type. What sort of location? Downtown/urban? Or suburban shopping center? Who are your customers? Office workers grabbing a 12-pack on the way home from work? Retired/disabled stopping by for a regular half pint of cheap vodka? You don’t want to waste money advertising until you understand your core customer base and where they are coming from to visit your store. Once you better understand who you’re trying to reach it becomes an easier problem to solve. Hope this help. Cheers, Justin

Message from a french guy, reading your blog. Interesting to see how american people can discuss business and share experience. I have always thought that I’d love to work over there. Reading your post and comments make me think I should really try to!

Bonne continuation à tous

Cheers

Pierre

Hi Pierre,

Venez aux États et nous pouvons commencer un magasin d’alcools spécialisée dans le vin français!

Cheers,

Justin

Hi, Justin

1)Looking into buying a liquor store in NorthWest of Denver. Gross is 1.6 mil, and the net to owner after all the expenses is $135,000. Asking price is 750,000 and not inlcuding inventory. 8 years on the lease left. Based on these numbers, how much would you offer? Do the numbers look healthy?

2) Although I am doing my due diligence such as requesting annual credit card statements, tax returns, P&L and inner computer generate reported to make sure that all match the 1.6 million figure or at least come close but any thing else you recommend or ideas that helps my due diligence to make sure those numbers are legitimate?

3) Store sells liquor and lottery but I also want to add cigarettes? Will that help with sale or is it worth it?

Any other recommendations that you might pass on to make sure I am making a good decision or something I need to watch out for? could be legality issues, competition etc.

Again thank you so much for your help!

Hi Romy,

(1) For a liquor store grossing $1.6 Million I would offer $400k and I wouldn’t pay more than $475k. Also, is the lease renewable at the end of 8 years? I would insist on an option to renew after the current term. How much for the inventory? You need to know what you’re getting and you should only be paying wholesale cost. You might also refuse to purchase any “dead stock”, i.e., inventory that’s just collecting dust and hasn’t moved in the past year or so.

(2) Tax returns should suffice. Find out what the breakdown is for Beer, Liquor and Wine. Beer is the least profitable category so, ideally, the store would do a strong % of sales in liquor and wine. If Beer is well over 50-60% your margins will be relatively thin. You might request to work the store alongside the owner for at least one full week to validate sales numbers. This time of year is slow but the store should be bringing in about $25k per week. Less than $20k and alarm bells should go off in your head.

(3) Adding tobacco is probably a good idea. At my store 10-15% of revenue was from tobacco sales so it can add a significant chunk. Plus it brings traffic. Add groceries and other convenience items is good too but you have to comply with State law which requires a separate cash register and a clear distinction between the retail space dedicated to liquor vs retail space dedicated to other sales.

There are lots of other factors. Competition is key, of course. So is parking, visibility, traffic flow, and on and on.

Good luck!

Cheers,

Justin

Hi Justin,

1)Buying a liquor store Southwest of Denver. Gross is 1.6 million from past 2 years, Net to owner after all expenses is $135,000 and 8 years left on the lease. Asking price is 750,000, inventory excluded. What would you offer? and lets just say if those above numbers are true, do you they look healthy?

2) I am doing my due diligence to make sure 1.6 mil is a legitimate figure by requesting annual credit card statements, tax returns, p&l and inner computer generated sales so I can match them. Any other ideas you can pass it on so I can verify the accuracy of the sale?

3) Store sells liquor and lottery, but i also want to add cigarettes and add groceries to boost the sale? Is that a good idea?

4) Anything else you can recommend for me to be aware of such as license, marketing or lease, competition?

Thank you much for your help!

Hi Justin,

Thank you again for the response. Is it possible to exchange numbers and talk at some point? I am coming close to making an offer and would love to talk with you and get some advice and I am willing to hire your services.

Thanks

Romy

Hello Justin,

Wow, thanks for all of your information. I’m in GA and currently looking into purchasing a package store(liquor store). The business is 8 years old, and sells have increased every years, 6% last year to be exact. $1.2 Gross sales and the least is 10 years remaining and can be extended. The store is fully supplied and fully staff but the inventory is not included in the $50,000 asking price. There is $300k in inventory which is not apart of the asking price. How should I approach this, especially the inventory price?

Hi Joe,

I assume you mean the asking price is $500k? If the price is really $50k pull the trigger! At $1.2M gross I would think the store is worth $350k or thereabouts. For the inventory, I would only agree to pay the actual cost that was paid by the current owner as documented by purchase orders/invoices/etc from distributors. In addition, I would ask to review the entire inventory and have the option to not purchase “dead” stock, i.e., inventory that hasn’t moved in the past year or so. You shouldn’t have to pay for the previous owner’s merchandising mistakes. Make sense?

Good luck with the purchase! Let me know how it turns out.

Best,

Justin

Hi Joe, did you pull the trigger on this? Mind if I pick your brain a little? 615-542-1295.

Thanks!

Hi justin, I have been able to save 75k cash.will I be able to open a liquor store

Yes, a small one. Look for opportunities with owner financing.

I am planning to buy a liquor store with real estate priced at 600k includes 100k inventory. Annual sales are 1 million. How much would I net with that kind of sales and no lease payments or mortgage payments?

Hi Dan,

There are a few more variables necessary to come up with a net income estimate. It depends on cost of utilities (refrigeration is expensive), annual licensing expenses, credit card fees and other misc costs. It also depends on your sales mix; for example, if you sell 80% Beer you’ll net less than if you sell 80% wine/liquor. Finally, how many paid employees will you want/need? The more you work, the more you keep in your pocket. All that said, and assuming you work the store full time, I think you could plan on clearing ~$100k per year. Maybe plan on a bit less the first year or two. By the way, given the numbers you laid out I would expect the real estate included to be worth ~$200k. If the real estate is worth less you may be paying too much. Good luck!

Best,

Justin

Hi Justin!

It has been interesting reading your blog. You sound like an amazing entrepreneur! I am currently finishing my Bachelor’s in Business Management with an Entrepreneurship/Leadership specialty. In one of my capstone classes, we have been asked to complete a business plan start to finish. I chose “party store” as we call it in Michigan, which is ideally a convenience/liquor store with a sandwich deli, pizza, and delivery options. (They let us deliver alcohol in MI!) Finance and start up costs are posing to be my most difficult area to come up with answers as most businesses do not display financial data for everyone to see. If I was starting up a small (2500ish sq foot) operation on a rental lease basis, where I would be responsible for purchasing inventory and deli equipment, what would your general advice be for me to come up with a “Mock” number to attach to it? Also, I understand Colorado is different than MI, but how long/how much did it cost to obtain a liquor license? Any suggestions to add to my plan would be greatly appreciated. Your article has already helped spark new ideas to add. My parents owned one when I was a teenager for about 8 years so I have a general idea of how things are ran and operated, I simple hate finance and this is the weakest area on my business plan.

Thank you!

Alyssa from Michigan!

Hi Alyssa, thanks for reading my blog! What do you have so far for a pro forma? I can give you some ideas for the liquor inventory piece of the puzzle but there will be many expense categories to cover. Furthermore, it’s difficult for me to know how much you might need in liquor/wine/beer inventory so you’ll have to make some guesses as to volume of sales as well as a likely breakdown for beer vs liquor vs wine sales. Make sense? Best, Justin

By the way, you can’t be a successful entrepreneur without understanding your financial data. So, get over your “hatred” of finance and think of it as an important tool for growing a business and achieving success. You might also hate mops but customers like clean floors. For small businesses financial analysis is just a matter of gathering basic information and translating into a set of numerical estimates. You’re probably making it more difficult than it needs to be. Start with a list of anticipated expenses. Revenue forecasting is far more of a challenge.

Hi Alyssa P !

I would like to have a look at your business plan that you did. I found you on liquor store blog.

thank you

here my Facebook : Rock Noel

Scenario: How much would you offer for a store grossing $600,000-$700,000?

What’s the % net income that’s resonance for this size (1,600 sqft) that gross between 600-700k? Is 15% good number to use as rule of thumb? Rent is $4,000 per month.

Hi Daniel,

Lots of factors to consider but, generally, I would want to stay in the $150k-$200k range. Net income varies depending on too many factors to list but 15% is feasible. The rent sounds high to me. Check market rates to see if it’s in line.

Best,

Justin

Hi Justin,

Great blog! I need to have a tutorial on the basics of selling into an account. Understanding margins, how to negotiate case prices for a brand new product, etc. Do you know of a good book? I would love to speak with a store manager. I wont be selling the product in Colorado and would sign a non disclosure agreement.

The product has a lot of potential. I cant discuss in a public forum. We are thinking of seeking out independent sales contractors who sell into accounts for us, having a wholesales group handling distribution. The distributor agreements with their sales force cuts heavily into profits. Looking to see if we can work around that.

Would love your recommendations, etc.

Hi Bailey. In Colorado retail liquor store owners are required by law to purchase through a licensed distributor. There are exceptions for Colorado-based brewers and distillers and I think you can buy wine directly from an out-of-state vintner if they don’t have their own distributor. So, at least in Colorado, you won’t be able to make an end run. Don’t know about other states. Sorry I can’t be of much help. Good luck! Best, Justin

Hi BAiley,

I’m in the beginning of my search to buy a liquor store, but i tought the same thing. I have studied in logistics and supply chain, cost price, management, inventory are fun to me.

I’m Canadian, and here only the governement can sell liquor, wine and beer are permitted to grecery strore and C store.

But every time I go in the US I’m always surprised by the ULTRA-UDGE inventory that the liquor has in store. I mean we have wall-mart here as well and pretty much the same stores but liquor are different. But having let say 12packs of 8 bottle of 12$ cost price of a kind for total of 1152$ is uneffective. And that’s the reason liquor store have 100 of thousand of dollar sleeping at no interest rate. Eventually when you see quickly the question : 1,6M Gross sale 365 days = 4383,56 gross sale per day daily expenses is 266$ (8000$ moth) and cost of goods lets say 80% (I know its less than that but just to be safe) 20% of 4383,56 = 876,12 – 266 = 610 EBITDA so at the end is it normal to have 200k 300k inventory… no. But i guess the licenced distributor is the Guy there… so He decides. How many different kind of bottle a store can handle ? I dont know that answer but for sure best seller are best seller but you dont need to have the inventory for the next year…I read that a good Lstore can change his inventory 8 to 10 times in 1 year. Well thats almost every 6 weeks. every 6 weeks you’ll have to rebuy a 300 k inventory. humm lets say again sells are 80K month and cost 80% so … the answer is yes. In real time logistics, I’ll take the exemple of wall mart… when the cassier scan your article, it goes as a sell to the warehouse and your product that you bough is back on the store next day…that’s real time logistics but liquor store who plays with inventory every 6 weeks that sounds a big lack of the industry… probably something is wrong with that inventory. I dont know how the supplier work seems to mw that hes the BOSS of your business in a certain way. What do you think Monsieur Justin ? Justin tu achete un inventaire de rhum peu importe la marque. Combien de bouteille il faut acheter pour arriver a un bon prix. et combien de temps ca prends avant que tu ne vendes ta derniere bouteille…. disons pour ton meilleur vendeur, et ton pire ?

I’m just looking for a 99,000 store with good cash flow in myrtle beach area.. I’m not planning on being rich but comfortable 55000 take home. I don’t that’s greedy

First off, awesome blog. There are not too many liquor store owners that would take the time to write such useful information. I would like to know what kind of Point of Sale software you would recommend? The options are daunting,

Thanks!

Hi Jay, we used “Lightspeed” and it was pretty good. Price was significantly less than some alternatives. Easy to use and runs on Mac which was a priority for my manager. My only complaint was limited reporting capabilities. Best, Justin

Justin

Thank you for the information it has been a great help.

I am in the process of putting together a bid for a Liquor Store in Southeastern Colorado. The Store is listed for $150,000 which includes inventory and real estate. Real estate does not have a great value and coolers need updated. I have also been told that the seller wants to retire very soon due to age and health which tells me that he would take less. The store owner told me that beer sales are around 60% Wine 10%. I have asked for the P&Ls and tax returns which I have not gotten yet, but should get soon. I have a feeling that the books might not be clean; cash might be leaving the business and not getting reported. Because of this I am going to look at purchases also. Can you tell me what kind of purchases/sales I should expect to pay this amount? Also can you tell me what the average margin is on the 3 main product categories.

Once again Thank you for your help in this matter and the help you have given everyone with this blog.

Hi Glen. $150k for the business + real estate + inventory sounds very inexpensive. What sort of revenue numbers are they quoting? When the price is too good to be true it may be a red flag. Ask for tax returns if you don’t trust the P&Ls. I can’t speculate on appropriate revenue for these numbers because I have no idea about real estate or inventory values. Average margins would be about 15-20% for beer, 35-40% for wine and 30-35% for liquor. But it all depends on your customers and their preferences. I suppose it always depends on your customers. Anyway, hope this helps a bit. Best, Justin

What is the best product to get inventory for, in other words what alchohol grosses the most money

I don’t mean to be flippant but the best product is the one your customers want to buy the most. Every liquor store has unique customers and each store’s “customer profile” is slightly different. When you buy inventory it should be tailored to your particular customer base. Some customers like cheap beer, cheap vodka and cheap whiskey. Some like high-end wines and spirits. As a store owner you need to find out what your customers want to buy. Then find ways to build a profitable inventory to serve their purchase patterns. Best, Justin

Thanks Justin I am a little new to the buisness and have not made any relations with suppliers, is there any suppliers who are trying to cheap stores and have outragous costs, I want to make sure I buy from the right people.

If you’re in Colorado then ALL distributors (licensed suppliers to retailers) are “trying to cheap stores and have outrageous costs”. Unfortunately there’s no where else to go as each and every distributor has a monopoly on products they distribute. Building a relationship with suppliers is still a good idea but don’t expect to be able to shop for better pricing (unless it’s for non-alcoholic products). Your only path to lower costs is via volume purchases. And, of course, you can only afford to make large purchases for product SKUs you sell the most. Sorry to be the bearer of bad news. Perhaps you’re outside Colorado where retailers have more negotiating power. Best wishes, Justin

Hi Justin, lets say the proposed change in the liquor law passes and grocery stores are allowed to sell liquor. If my liquor store is anchored by a grocery store how likely would the city give another alcohol beverage license to a business that is right next door to a place that already has an existing license, would the grocery store chain attempt to buy my liquor stores license. What are your thoughts on that scenario.

Difficult to say. My best guess is that you’d be SOL. Might want to try to add a clause to your lease releasing you in case of change in the law. Or proactively begin communication with the grocery store management. They may want someone to manage liquor inventory for them. That said, I don’t expect the law to change so I would be more concerned about maintaining/growing revenue and profit. Best wishes, Justin

quite possible what is your favourite tequila.

The one that sells the most.

Hi Justin, Like others here, I am looking for opinion and knowledge before seriously contemplating a store purchase.

In a nutshell, the store has been operating for 35+ years, the present owner is an absentee owner with other business.ventures.

The owner will lease turn the key business for 1500 a month for 1 year with lease fee deducted from purchase price if property is bought after one year. Asking price is 160,000. Of course inventory would be purchased at start of lease. The gross for last year was 287,000 but I do not have a breakdown of this gross as for profit/loss.

In your opinion does this seem like a good venture? Would you have any idea what the gross profit percentage might be?

I should add they now sell beer, wine and liquor, but there is an additional 800sq ft available in store but not used at present for retail space. What other products could be added to increase sales?

Your advice would be greatly appreciated.

Unless the deal includes real estate or some other special consideration the price tag for the business seems too high. I wouldn’t pay more than $100k and $80k sounds about right to me. Not including inventory. Gross revenue is pretty low. How has it changed over the past five years? Going down? Holding steady? Moving up? I think I would favor a deal with higher gross. I like Mom & Pop size operations for owner-operators but this sounds more like a Mom *OR* Pop (not both). Being that tiny makes you even more vulnerable to the pricing whims of distributors. To add sales revenue I would add tobacco for sure. Maybe lottery. Depending on state law maybe use the 800 ft to sell snacks etc convenience store style. Hope this helps. Best, Justin

Hi Justin, I’m sorry, in my last post I didn’t clarify that the asking price included everything, equipment, building (1900sq ft) and large paved parking lot.

As for change as I understand, the gross has gone down since the present owner has had it by about 30-40k. The owner admits this is mostly from not operating it himself and not managing it properly because of his other commitments.

It is close to a lake, maybe bait and fishing gear along with the convenience items? Oh, I didn’t mention the state is MN.

Thank you, again

Dave

Is the location rural? If so, might be very slow when it gets cold, i.e., most of the year….unless there’s a big ice fishing scene on the nearby lake. Fishing gear is a good idea. But I would want to see a transaction count to better understand seasonal variability.

The price seems reasonable since real estate and equipment is included, depending on market values for similar property in the area. You may want to request a provision to avoid depleted inventory when you take over. You don’t want empty shelves.

In this situation I would probably want an owner carry deal. If he says he wants a clean exit so he can take the money and move on I would run the other direction.

Cheers, Justin

Hey Justin,

Im from Canada and I’m thinking of buying a liquor store in California, Los angles area. Any tips?

Be sure to start out with plenty of cash in the bank (after you purchase the store) to ride the inevitable ups and downs while you learn the particulars of the customers and suppliers in your market. Cheers, Justin

Hi Justin,

Very impressed with your blog, business acumen and willingness to help others! I’m contemplating the following opportunity and would value your opinion. I’ve read that inventory should turn over 8-10 times per year – this seems to be about 6.5X at value below. Store is in NY – wine and liquor only. Also curious as to what you think about an owner putting in 40-50 hours with employees covering evenings and weekends?

Store is located on a very busy roadway in a large shopping center next to a supermarket. This business has had continued sales growth each year since it was started in 2006. Past year the store grossed $1,833,796.03 (+7.5% from prior year) with a net income of approx. $263,000.00. At 2,500 sq. ft. – large retail sales floor and a tremendous amount of storage space. There are 6 years left on the lease (it can be extended). I’m told all sales and figures are verifiable. State of the art POS software. Price is $675K + $285K in current inventory.

many thanks,

David

Hi David,

Sounds like a good opportunity with strong cash flow. Asking price of $675k seems high. I would offer $550k and try not to go beyond $600k. Be sure to verify inventory and ask for an option to reject inventory that hasn’t moved in the last 6-12 months (start with 6 mo, agree to 12 if push back).

Owner working 50 hours per week should be fine if you have good people and treat them right. I think you’ll want to work on Saturdays as it is typically the busiest day of the week. Maybe take off Sun-Mon.

Good luck!

Justin

David:

Did you end up buying the store – I am looking at one, also in NY, that seems to be very similar (Not the same one though). Just curious, thanks.

Tony

Hello Justin,

Great article sir! Thank you so much for taking the time to answer all the questions; I’ve learned so much from your blog. Justin, I’m looking into a store in a small town, and wanted to get your advice. Liquor store is doing 2.2m in annual sales, they are asking 1.5 m; it’s with real estate. Location is great, right off the main road in town, with ample parking. Beer sales are 18 % and the rest is wine and liquor. Please let me know what you think.

Thank you

Jay

Hi Jay, how much do you think the real estate is worth? Also, does the asking price include inventory?

Hi Justin–great article and appreciate all the responses you’ve given to the comments. You’re giving out a lot of vital information/details.

I’m looking to open a new liquor store with maybe a different approach than others. I have a partner and would like to invest 75k each. According to above comments, we would need to be in the $600-$650k gross range if we invest $150k total, right? If that’s the case we should be in the $90k cash flow range (divide by 2), we should each see about $45k annually in a traditional, owner ran store?

Now, rather than both or one of us behind the counter we want to hire employees and have the pay be commission based. The two owners would be focused on marketing and managing the operations/inventory while the employees are behind the counter. In past experience I’ve noticed employees don’t really care about growing a store unless there is some incentive for them. I do understand paying commission will eat into our profit but I think in the long run we could have employees that could push sales and would be willing to educate themselves in the products. If we were to go with commission based pay, how much or what percentage do you feel would work well? I’m thinking with wine and liquor having a higher margin we could give a higher commission percentage to the employees for those products.

After paying commission to the employees if we both only see $30k cash flow each, I would be okay with it as we could try to grow and own multiple liquor stores with the same concept in place, possibly adding tobacco, water pipes (and other smoking devices), and lottery.

Any help/advice is appreciated!

Thanks

Hi Harvey, thanks for visiting and posting your questions. By “new liquor store” do you mean start from scratch? I can’t say that a $150k investment will achieve/require $600+ gross. Depends on too many factors, especially the local market dynamics, location, competition, etc. $90k sounds about right if you’re able to achieve $600k+ gross but that assumes at least one of you is working full time. If neither of you works the store you may not have much of anything left at the end of the year. For a store at that volume I recommend you work behind the counter. You’ll need to be there more days than not if you’re responsible for inventory/ordering etc. More importantly you need to get to know your customers so you can provide the level of service necessary to keep them coming back. I’m not a fan of commission schemes. If you take good care of employees they’ll take care of you. If you set up a commission plan you’ll end up spending a lot of time administering the plan; your time is better spent elsewhere. My advice is to find a partner who wants to work at the store full time. Sorry, this is probably not what you wanted to hear. You and your partner may be able to make money by building the business and selling it but I wouldn’t expect any cash flow along the way if neither of you will be working full time hours. Best wishes, Justin

Hello Justin,

First of all, thank you for all the information you are providing and for posting this great blog. It is very informative for the first time business buyers. Also, it will motivate people like me to post and share our experience so people make less mistakes and excel.

I plan on buying a liquor store in IL. I would really appreciate any kind of input/advice from your side.

Here are the numbers from P/L:

Asking 330K + 160K (inventory)

On lease for $4600 (as per my DD slightly high for that area)

Total Income: 989,906

Gross profit: 228,406 ( PM around 23% for last 3 yrs)

Net Income: 30,781. (Owner has 5 employees and also pays salary to self) I have to find out how she pays herself.

Payroll expenses are 82K. Currently she is paying 3k per month in salary to employees so I am guessing 82K-36K=46K is her salary.

Any thoughts/questions/advice are greatly appreciated. Thank you Justin.

Om

Hi Om. These numbers seem pretty good. Asking price is slightly high but not unreasonable. The seller will take $300k which isn’t too bad but you might try offering $270-275. Make sure inventory value is based on wholesale prices and try to avoid taking “dead stock” (product that hasn’t moved in the past 6-12 months). Depending on your financial circumstances, you might ask about the possibility of owner carry so you can begin with the strongest possible cash position. Good luck! -Justin

Thank you very much for your input. What the owner gave me is the P/L documentation. How do you verify the sales and makes sure the numbers are correct? I am guessing tax papers?

Yes, once you’re “under contract” it would be appropriate to request tax returns to verify the P&L numbers.

Great. Thank you Justin for your input. I will update you if the deal goes through. ~Om

Hi Justin. How are you? I have couple Qs please help me out, any comments or your advice is appreciated.

Story: One liquor store in GA sell 6,5 millions plus 1.0 million inventory = 7,5 millions ( including store real estate 12k sqf = $2,5million)

Information :

***Based on I -1065 sale increase 5% each year. Total sale 7,7 millions

Cost goods sold. 6,4 million

Gross profit. 1,3 million

salary 400k

Repair maintenance. 68k

Rent ( they filed) 16th

Tax , license. 54k

Interest. 41k

》》》 ordinary business income is 290k

*** BASED. on owner info given

Sale without tax 7.8 million

#employees : 14

Yrs business. 19yrs

inventory 1.0 million

Margin: 17%

Expense:

Payroll : 400k/ y

Lic fee: 6500

property tax 14k

insurance. 14k

electric. 36k

water. 500

Trash 1600

Tel+ Internet 2000

Alarm. 450

Credit fee 4500/month x 12= 54000

POS system

40% of sale is wine

43% is liquor

15% is bear

Rest is misc

Dear Justin, they asked 7,5 million, could you please give me an advise HOW MUCH WE CAN MAKE AN OFFER? OR WE BUY.

Thank you for your time and kindness to help me out, any your advice or comments is appreciated.

Dearest,

Paul.Rx

Hi Paul,

If I understand correctly they are asking $4M + $1M inventory for the business and $2.5M for the real estate. I also see $7.8M gross annual sales in the most recent 12 months. Is that correct?

(1) I can’t help with the real estate valuation. You should get an appraisal from a good realtor who knows the local market.

(2) The business looks very profitable so you should expect to pay a premium but I think the asking price is high.

(3) Keep the real estate, inventory and business separate in your negotiations.

See (1) for real estate.

For inventory, offer to pay the cost of documented (they should be able to show purchase receipts) on-hand inventory but reserve the right to reject dead stock (hasn’t moved in 12+ mo). You shouldn’t have to inherit purchasing mistakes.

For the business, I would offer $2.5M and I wouldn’t pay more than $3M.

All of these suggestions assume the business has been growing, the surrounding trade area is stable or growing and there’s no sign of new competition with deep pockets entering the market.

Hope this helps. Good luck! -Justin

Hi Justin. It’s very helpful. Thank you very very much Justin.. I am very happy to accept your advice and I will make a deal like that. I also check the real estates to see what going on.

Dearest,

Paul.rx

Hey Justin I am looking into one large liquor store would like to get your advice over phone if it’s possible?

Hi Jack. Use my contact form to send me a private message and we can go from there. Thanks, Justin

Paul,

The numbers you have given from the GA liquid store are similar to a store I am evaluating.

Is the liquid store you’re talking about located in Johns Creek (all brick building)?

Would you mind giving me your phone number or email address, I would like to know if you ever got it? Why and why not? I am looking to buy a liquid store at similar price point here in Atlanta, GA. Thanks

Hey Paul,

So did you got it or not ?

Hi Justin

This is a great page with many invaluable tips… well done sir!

Ok… I have a friend looking to set up from scratch a liquor store in the Rustenburg area of South Africa. This is a total start up from nothing. Is there any advice you could offer on selecting location, very speculative startup costs and/or any other considerations that you would be working on in development of an initial business plan?

I have read the entirety of comments and answers on this page so now have much information to digest. How would you approach this situation early days as it is?

I would really appreciate any advice you could give.

Warm regards

Jason

Hi Jason. I don’t know enough about South Africa to offer advice. Generally speaking I would recommend having more cash on hand than you think you’ll need. Sorry I can’t be more helpful. Best wishes, Justin

Hi Justin, how are you? I have couple Qs, please please help me out, Justin. I do appreciate your time and kindness. The Qs regarding FIRST OFFER AND SELLER INFO

1. What do we need to know/have about seller before 1st offer ( they just gave me Form 1065 and all info i posted above) .

1a. In general, what do we have from seller before first offer

2. We have bank loan officer, they introduced me liquor store, they said seller has Agent, but I don’t see them.

2a. So do i need an agent for me.

3. Is it right? If i have first offer document, do i need an Attorney to do that. ( they charged me 750) if we don’t need that, what we have to do offer in official

4. Do I have to pay from my pocket for appraisal ? Please help me out about appraisal, when and how we need to do that

5 . Even now we dont know much seller info, but we do offer we have to have some conditions. So i list following. Plesse help me anything else we have to do.

SPECIAL STIPULATIONS REVISED

1. Seller shall owner finance $500,000 of the purchase price. Buyer shall execute a two (2) year standby Promissory Note providing for fixed, simple interest at the rate of five percent (5%) per annum from the date of closing, amortized and providing for payments commencing on the first (1st) day of the twenty- fifth (25th) month following Closing, but callable by Seller on the fifth (5th) anniversary of Closing, such that the entire amount is paid in full.

2. This contract shall be contingent upon the closing of the existing business located at ( address)

3. This contract shall be contingent upon Buyer’s ability to obtain an SBA loan of at least 75% of the purchase price. Upon written notice of loan denial, the parties hereby consent to authorize Holder of Earnest Money to return Buyer’s Earnest Money within three (3) business days of receiving said notice.

4. This contract shall be contingent upon an appraisal by a licensed Georgia appraiser equal to or greater than $3,500,000 for the land and building and $2,3000,000 for the liquor store Business.

5. The parties shall account for inventory at least one (1) day prior to closing, and the inventory must be worth at least $1,000,000, and inventory must be recent with expiration date being no less than six (6) months from the closing date.

6. Buyer shall pay only closing costs associated with obtaining the SBA loan. Seller shall pay all closing costs associated with this transaction (the sale of land, improvement, and Business).

7. Seller warrants that the gross profit margin of the liquor store Business is at least eighteen percent (18%).

8. Seller warrants that Seller and the Manager(s) employed at the liquor store Business shall provide training to Buyer, at no additional cost to Buyer, from the date in which Seller receives the commitment letter issued by the Lender until thirty (30) days after closing date. Training shall be provided every day that the liquor store business is opened and from the time the business opens to the time that the business closes. This provision shall be considered a personal service agreement between Seller and Buyer. Seller acknowledges that a material breach of this paragraph will result in irreparable and continuing damage to Buyer for which there will be no adequate remedy at law. Therefore, the parties agree that any intentional, material breach by Seller of this paragraph shall result in, as liquidated damages, the amount of $2,000 per day for each day in which Seller is in breach of this paragraph. The parties expressly agree that this provision does not represent a penalty or punitive clause but represents an agreed measure of damages, the amount of which is impossible to determine on the date of this Agreement is signed. If Buyer elects to recover liquidated damages under this provision, however, such liquidated damages shall constitute Buyer’s sold and exclusive remedy.

9. Seller shall provide all documents requested by Buyer’s Lender within three (3) business days of receiving request from Buyer and/or Buyer’s loan officer/Lender.

Justin. I know you are busy of schedule , I am proud of you and appreciate what you have done for me.

Thank you very much Justin. You have wonderful life.

Hi Paul,

I’m not an attorney and can’t offer any legal advice. You should consult an attorney before signing any sort of formal purchase agreement.

You don’t need anything from the seller to make an offer. Start with a verbal or informal “letter of intent” to begin a negotiation. Be sure a formal offer is contingent on financing, property inspection and verification of sales data so you have the option to walk away once you learn more. It’s not at all uncommon to renegotiate price/terms after you’re “under contract”. In fact, it can be a good strategy because the seller may start counting their money before the deal is done giving you leverage.

If you’re borrowing money from a 3rd party you’ll almost certainly be required to pay for an appraisal.

Best wishes,

Justin

Justin. It’s very helpful, I’m so confident after read your reply. Again. Thank you very very much Justin

Dear,

Paul

Someone is offering me his liquor license for $90k which has been served a show cause notice by county inspector. How should I go about this? I have ZERO idea about liquor business or any retail business.

Hi RK, you’ll need to consult with someone who knows the laws in your State and Municipality. In Colorado no liquor license is worth $90k unless it comes attached to a functioning business with customers, also known as “blue sky”. Good luck, Justin

Hello Justin,

Thank you so much for your insight and expertise. My husband has recently taken and interest with opening a liquor store from scratch in the Atlanta area of Georgia. We do not have any start up cash, and would be looking to the bank for a loan. We also would be looking to sign a lease for location for the business. The vast inventory alone seems daunting enough for me to try my hand at another business, however, my husband is hopeful that a liquor store is easy enough and brings home ‘easy’ revenue. He is willing to work in the store full time, and I will help out on weekends.

I have read your post as well as the comments. I know it will be challenging but, in your opinion, does it seem feasible for us to try our hand with such a business, considering we have no cash to start with and not a lot of knowledge about this industry?

Thank you for any thoughts,

Jo

Hi Jo. I would recommend against it. In Colorado it’s illegal to borrow or lend money for the purchase of inventory. Note this is based on my attempt to read the very complex and poorly organized liquor code in Colorado. So I could be misinterpreting, but it seems like a sensible regulation because it’s a really bad idea to borrow money for inventory. I don’t think the value of the inventory can be insured against theft or other types of loss. If you can find a willing insurer they’d probably charge you a fortune. Also, your lack of experience is concerning. One of you should at least have some retail, book keeping or general inventory management experience; ideally, you’d also know a lot about the products you’ll be selling. My recommendation would be to suggest to your husband that it might be wise to work as an employee in a liquor store before making the plunge. This would help him learn the ropes on someone else’s dime. He can offer to work for cheap and maybe a manager or owner could teach him more than cashiering. There’s a lot to learn if you want to succeed. Nothing in business ownership is “easy”, especially not revenue. Hope this helps. Best, Justin

Hi Justin,

I’m looking at purchasing a liquor store, few questions and comments:

1. This store needs to be closed and cleaned up, I want to change it into a fine wine and craft beer store. The neighborhood is ripe for it, highlands area in Denver.

2. The P&L didn’t match the tax returns. Per the seller, he indicated that he wasn’t keeping all his sales records, I think he’s not reporting cash sales.

3. How do I figure out the right offer when his P&L isn’t supported by his tax returns?

4. The broker is telling me that cash and credit card sales are 50/50, that doesn’t make sense to me, is that reasonable?

5. I believe you are recommended to offer 25-30% of the annual sales, is that correct?

Thanks

Mark

Hi Mark,

Many liquor store operators under-report cash sales. Base your offer on his tax returns. Let’s say he claims annual revenue is $1 Million but his tax returns say only $800k. Then offer 25-30% of $800k, i.e., ~$200k-$240k.

Re cash/credit sales – ask if it’s 50% of transactions or 50% of volume. If you’re working up a pro-forma you’ll need this to estimate credit card fees. 50% doesn’t seem unreasonable to me but who knows. Check the credit card fees paid in his P&L for guidance.

Hope this helps. Good luck!

Best,

Justin

Justin,

Thanks for your feedback. I’ll base it off his tax returns. 2014 tax return gross sales were 245K. They are asking 170K which is a lot higher than 30% of 245K. It’ll be a fun negotiations.

Thanks again

Hi Justin,

Thanks for the valuable insight!

At a glance, what are your thoughts about this newly renovated 1800 sq ft store for sale in NY?

Asking $450K + inventory. 10 years left on renewable lease. Good parking.

Prior year gross sales: $1.35m Absentee owner paying little over $100K in salaries. That would change some as this would be primarily owner operated. Nothing wrong with a competent, cost effective manager but much more would be superfluous.

Asking price seems in ball park but I’m thinking $350k with a ceiling of $400k plus a verified wholesale number on inventory, minus dead stock (estimating $200k). As an growth oriented entrepreneur, I’m confident I can increase business and timely streamline inventory to meet customer trends.

Just not sure if the math works: should I be looking at 15% benchmark profit margin ($202K), assuming I can lower salary expenses, and expect to pull $125k – 150k/year? I would like to eventually see pocketing over $200k/yr. At that rate the complete ROI would be 3-4 years.

What is your relative gut feeling on this deal?

Thanks!!

Hi Steve,

This sounds like a good deal. I think $400k is fair. As far as profit, how much net profit are they showing with the numbers above? I wouldn’t count on the big profit numbers rolling in right away and not at all unless you’re working a lot of hours. In any case, this does sound like a pretty good deal. I can’t have a gut feeling without meeting the people involved and seeing the location but if your gut is giving you the green light I’d go for it.

Cheers,

Justin

Hi, can you tell me who I need to talk to to get pricing on beer, wine and liquor. I am trying to create a business plan but don’t know where to get costs.

Hi Andi – you need to contact local distributors. You could also try talking to liquor store owners in the same market. Good luck!

Hi Justin,

My friend and I are thinking of buying Liquor store in Oklahoma . Grocery stores in Oklahoma do not sell Liquor yet, but it may happen anytime . How would it effect out business if they start?

The seller is asking $250 K + $120K inventory, gross sales are about $1.2-1.3 million. The owner’s profit is about $140K, he is piddling around for about 30 hours a week , not really doing much, always has another employee there.

We are planning to work 60 hours/week between both of us and keep another employee in the evening, so eliminate about 53 hours of other employees. Rent is $2500, the sf is about 2000, about 1600sf the floor. The store is located on the busy road with Walmart about 1 mi and no other grocery stores to the east.

Can we still hope to make same amount of money ,even if grocery stores will start selling liquor ? That’s out biggest concern .

Thank you.

Hi Lana,

I don’t know anything about the liquor laws or related politics in Oklahoma so I can’t really speculate. If grocery stores are able to sell liquor and the neighboring Wal-Mart chooses to participate it will be extremely difficult to compete. I think you can safely assume your revenue will decrease if the laws change in favor of grocery stores. But I would think the retail liquor lobby would be able to negotiate some sort of concession for independent liquor store owners.

If it were me, and I really liked this opportunity, I would use the uncertainty to negotiate a lower purchase price with the current owner to help offset the risk. Or perhaps ask for owner financing so he shares part of the risk.

Hope this helps.

Best wishes,

Justin

Hi Justin,

I live in the great state of Tax(Mass)achusetts. My wife and I have been kicking around the idea to open a liquor store in a pretty busy main road where I am sure one complex we are looking at the lease is high. As far as what we would need up front I assume we would have to apply for a liquor license which I am sure if expensive here in Mass. Is that along with inventory a pretty pricey up front cost I assume? Thanks

Hi Sean – Yes, inventory would be the biggest expense if you’re starting from scratch. Depending on the size of the store you’d be looking at somewhere in $40k-$100k range, possibly more, to have a competitive selection. Good luck, Justin

Hi Justin,

Enjoyed your article. It was very informative. Can you give me a percentage breakdown of what takes the most time running a liquor store? I imagine inventory/purchase orders consume a large portion of your time. Is there something that a typical person wouldn’t guess or clearly see that requires serious attention running the store?

Thanks,

Allen

Hi Allen, inventory management and cash flow management are the two biggest headaches. I’d say the other key is to face the reality of working behind the counter for long hours each week. A small/medium liquor operation won’t be profitable unless you are working the store full time rather than paying for lots of cashier help. Good luck! Best, Justin

Hi Justin,

Thanks for the information. Could you see a liquor store making it if they were closed from Friday evening till opening again on Saturday evening? Do you think a reputation as primarily a high end store would help or hurt with this schedule?

Hi Cole. No way. Friday and Saturday are the biggest sales days of the week. If you’re closed you’ll get your ass kicked…unless you’re the only game in town. A reputation as a high-end store is good if the population in your trade area is equally high-end. If not, you’ll spend too much on inventory that won’t move. Hope this helps. Best, Justin

Hi Justin,

Reading through your blog has been very enlightening. One of many questions I have is when buying a liquor store in Colorado, the buyer determines there is dead inventory, how does the buyer approach the seller. Do you know what the seller can legally do with the inventory? If possible I would like to talk with you in person about our endeavor. TIA for your reply.

Hi Nanette, the seller can’t do much with the dead inventory unless he can find another store to purchase it (and then only up to $2,000 if I understand the complex regulations). When I sold my store I had to take the dead inventory home. It’s become a go-to source for gift giving but much of it will continue to collect dust. Happy to chat further. Use my contact form to send a private message. Cheers, Justin

Hi Justin,

I’m considering a liquor store up for sale in Kansas. I would greatly appreciate it if you could give me some insights as to whether this is a profitable or safe buy to dive into. The business is posted for 165k asking price plus another 75k for inventory. However the FF&E is not disclosed (which leads me to believe that the 165k does not include equipments like refrigerators) How much would FF&E run on the average for a liquor store of 3400 sq ft?

gross revenue: 912k

cash flow: 67k.

Facility is about 3400 sq. ft at $3300 per month

The mix of revenue is 55% beer, 25% wine and 20% liquor

There are currently 7 part time employees, so I’m assuming the owner is working the store full time himself. I won’t mind working the store some myself too. But eventually I would like to just hire a manager and take over the store.The store is located in a strip mall, which is in the process of redeveloping, and posting says the store has good visibility as well as location to several large apartment complexes.

Could you please provide your opinion?

Also, I read that Kansas just passed a bill this year that would allow grocery stores to sell liquor and wines starting July 2018. How much do you think this would affect the sales of an individual liquor store?

Thank you so much!

Hi Jessica,

The price seems reasonable but that may be due to the potential impact of grocers entering the market. If there’s a decent grocery store near your location the $900k gross could drop dramatically. And 3 years will go by pretty fast.

I think I’d probably slow down and learn as much as you can about the legal changes and what they’ll mean. Doesn’t mean abandon the idea of liquor store ownership as there may be an opportunity to buy out a running-scared owner at pennies on the dollar.

Hope this helps.

Best,

Justin

Hi Justin,

Your article was very informative. However I have a question. I am looking to join the craft spirits industry, and as you said, the distributors hold all the power thanks to the 3 tier system. I am a little concerned that getting products onto the shelves of retailers may be difficult as most retailers want to deal with just the major distributor accounts, and we all know that getting the distributors to pay attention to a new brand is like pulling teeth. My question is, is it possible for a retailer, or a group of retailers to force a major distributor to pick up a brand that they want on their shelves, and is there some sort of central ordering system that retailers use to place orders from their various distributors?

Thanks, and looking forward to your response.

Eddy.

Hi Eddy. It will be an uphill battle. In Colorado, a Colorado-based producer of beer, wine or spirits can sell directly to retail liquor stores (in Colorado) but most of them end up working with a distributor. If you’re starting small you can certainly go door to door and sell to retailers. If not, you’re stuck working with distributors who are already pushing too many SKUs. It may be possible for retailers to band together but I think the system is set up to avoid such collaboration and bulk purchasing. And, even if it didn’t run afoul of the liquor code, it would still be a challenge to form a retail coalition. You might contact the Colorado Licensed Beverage Association and ask them for input. They know much more than I do. Here’s a link to their website: http://myclba.com/

Good luck!

Hi Justin,

Great blog! I quick question on inventory – you mentioned $40-$100k are needed for inventory – is that to stock all coolers “once” and from then on it is on a rolling basis or do have the same amount of floor space/shelves/cooler capacity in storage in a warehouse (in effect you buy 2x capacity total upfront)?

Thanks! Claudia

Hi Claudia,

Well, if you have lots of extra cash laying around buying extra inventory might make sense because you’d likely get lower prices for buying in larger volume. But it depends on how much lower prices would be per unit. It might not be enough. That said, most people don’t have the luxury of surplus cash. So, if you’re starting a new store from scratch you’re probably looking at stocking all coolers once and then going into replenishment mode thereafter. Also note the $40k-$100k range may not hold true depending on your market (if it’s high-end it will cost more) and your store square footage (if you have a bigger space it will cost more) but, in any case, you don’t *need* 2x capacity up front. Hope this helps.

Best,

Justin

Hi Justin,

Thanks for all the valuable information above. I am looking at a liquor store in florida, sales of 820,000 last year, previous year 540,000 and the year before 400,000 the store is only five yrs old and the owner is asking 600,000 nets 126,000. I think 430 should be a fair price as it includes 125,000 inventory. Do you think I should rely on the numbers, they do come from tax returns but only last years sales were high the years before were comparatively low. Should I rely on the recent numbers and base the price only on last year’s return?

Thanks for your inputs.

Kulu

Hi Kulu,

I would want to understand how the revenue more than doubled in 2 years. Seems suspicious. Maybe ask for a monthly breakdown. Even if the $820k figure holds up I wouldn’t pay more than $250k + inventory.

Best wishes,

Justin

Hi justin ,